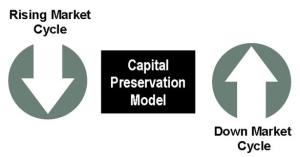

Unlike static buy-and-hold models, our Advance and Protect process involves proactive defensive positioning that seeks to preserve capital in falling markets, combined with offensive positioning designed to participate in rising markets.

Our strategy relies on both quantitative and qualitative measures, rather than a “buy and hope” approach. Quantitative information includes such things as price, volume, and momentum, which help reveal entry and exit points (as noted in the chart below). Qualitative inputs include a deep understanding of the fundamentals of the economy, markets, and investments in which we invest.

- The Money Market Fund is used as a position.

- The Money Market Fund balances risk.

- Our Advance and Protect process attempts to stair-step account values.

- We use scientific analysis to follow long-term trends.

Our Advance and Protect strategy is a capital preservation model with an offensive strategy. Its primary directive is to control risk. The objective of the process is to capture growth when the market is rising and protect principal when the market is falling.

Our approach incorporates both buy and sell disciplines in an effort to help protect your hard-earned wealth through all market conditions. Our process monitors each portfolio component daily and adjusts your investment mix as the business cycle evolves.